Account to Account Transfer, e-Wallet registration account, NEFT/RTGS, and Net banking are some of the payment modes available in Delhi for stamp duty payment.

Latest News on Stamp Duty and Registration Charges in Delhi

DDA Decides to Increase Property Registration Charges by 8% in Illegal Colonies

September 18, 2023: Under the Pradhan Mantri – Unauthorized Colony in Delhi Awas Adhikar Yojana (PM – UDAY Scheme), the Delhi Development Authority (DDA) has increased the property rights charges. The DDA has approved an 8% increase in the annual charges for property registration in Delhi in unauthorized colonies.

The PM – UDAY Scheme was launched by DDA to allocate ownership rights to people in unauthorized colonies. There are around 1,731 illegal colonies in Delhi. The scheme was launched in October 2019 and became operational in December 2019 to allow property registration under the Recognition of Property Rights of Residents in Unauthorized Colonies.

Also, the scheme is intended to help around 40 Lakh families in the illegal colonies in Delhi. The charges will increase by 8% every year. The existing charges will be applicable only till March 31, 2022. The incremental charges will be applicable from April 1, 2022. Following is an example of how the charges will be calculated.

Property registration filed before April 1, 2022

Property area – 100 sq m

Category of the Government Land in Colony – G

The deposit charges that need to be paid by the applicant will be Rs 5,775

However, if the Property registration is filed after March 31, 2022, but before April 1, 2023, for the same 100 sq. m in G category colony, the revised deposit price for property registration in Delhi will be Rs 5,775 + 8% that will be Rs 5,775 + 462 = Rs 6,237.

Also, if the application for property registration in Delhi for an unauthorized colony is filed after March 31, 2023, and before April 1, 2024, for the same 100 sq. m area and in the same category, then the charges will be Rs 5,775 + 8% + 8% that will be Rs 5,775 + 462 + 462 = Rs 6,699.

Transfer Duty in Delhi Increases by 1% for Transfer of Immovable Property

July 13, 2023: In a recent letter issued by the Municipal Corporation of Delhi dated July 10, 2023, the transfer duty on immovable properties has been increased by 1%. Based on this, the transfer duty in the case of females has increased from 2 to 3%. It includes the third gender as well.

At the same time, in the case of males and others (including any other entities), the transfer duty has increased from 3% to 4%. The new transfer duty charges are applicable from the issue of the increment notice, i.e. with immediate effect. The implementation of the same must be done across all offices of sub-registrars in GNCT Delhi.

The increase in transfer duty fees is only applicable if the value of the instrument to be registered is more than Rs 25 Lakhs. For instruments that are up to Rs 25 Lakhs, there is no change in the amount of transfer duty.

As a result of this decision, there is a possibility of a dent in the sentiments of the home buyers as It will increase the overall cost of stamp duty, registration charges, and GST on such transactions.

Delhi’s Stamp and Registration Fee Collection Increased 2.5 times in 9 years

May 2023: According to data by TOI, the Delhi government’s revenue from stamp and document registration has increased about two and a half times over the last nine years.

Compared to roughly Rs 2,308.2 crore in 2013–14, the revenue department received Rs 5,736.7 crore from stamps and registration fees in 2022–23. The sum comprised Rs. 4,668.7 crores in stamp duty revenue, Rs. 889.7 crores in registration fees, and Rs. 178.2 crores in court fees for cases heard in revenue courts that were paid online. Officials stated that the collection under the stamp and registration programme increased by about 16% in the most recent fiscal year compared to the 2021–22 fiscal year. The revenue under the head was Rs 4,952.6 billion in 2021–2022.

Single District Property Registration Will Soon Be Implemented in Delhi

April 2023: Property registration will become easier in Delhi. The capital will soon be combined under one single district. It will enable people to register properties from any sub-registrar’s office. The LG of Delhi, VK Saxena, highlighted that making the system online will drastically reduce the harassment the public faces in sub-registrar offices during property registration. Further, the no-objection certificates will also be issued electronically. Thus, limiting and eventually eliminating the human interface. Delhi will soon have the country’s first Online Complaint Filing Management System. (OCIMS). The system will enable filing complaints electronically. With the implementation of the electronic system, the entire process will become more transparent and help reduce corruption. Once the system is implemented, complaints will not be accepted physically. Proper evidence must be uploaded to ensure that people are not misusing the system. People will also have to authenticate themselves using the Aadhar Number.

Stamp Duty and Registration Charges in Delhi in 2023

The rates of stamp duty in Delhi differ for males and females. Also, the stamp duty rates differ slightly for regions falling under the NDMC and Delhi Cantonment areas. The registration charges remain the same.

Stamp Duty Charges in Delhi in 2023

In general, the following rates of stamp duty are applicable in Delhi.

|

Category |

Stamp Duty Rates in Delhi |

Stamp Duty Charges in NDMC areas |

Stamp Duty Charges in Delhi Cantonment Board Area |

|

Male |

6 Percent |

5.5 percent |

3 percent |

|

Female |

4 Percent |

3.5 percent |

3 Percent |

|

Joint Ownership |

5 Percent |

4.5 percent |

3 Percent |

It must be highlighted when a property is sold in the New Delhi Municipal Corporation (NDMC) area; the stamp duty is 5.5%. The stamp duty is 3.5 % of the cost of the property for women buyers in this area. The stamp duty is 3% when the property is sold within the Delhi Cantonment Board.

Also read:How to Check ROR Delhi Land Record

Factors Determining Stamp Duty Charges in Delhi

The stamp duty and registration charges in Delhi are decided by the state government. The Stamp Duty charges in Delhi are determined by several factors such as

-

Location of the property: In Delhi, circle rates for residential plots are based on the category of the area. For example, in Category A areas, the circle rate is higher than in Category B. Similarly, in the Category D area, the circle rate is higher than in the Category G area.

Also Read: 10 Most Affordable Localities in Delhi

Registration charges in Delhi in 2023

Regardless of gender, for the registration for the sales deed, all buyers in Delhi must pay 1% of the deal value along with the stamp duty.

Thus, a man who purchases and registers a property in New Delhi will pay 7% (Stamp duty plus registration charges) of the property costs while a woman pays 5% (Stamp duty plus registration charges) of the value during registration.

When a house is registered together on behalf of a male and a female, during the time of registration, they pay 6% of the property cost.

|

Property Registration Charges in Delhi |

|||

|

Gender |

Delhi |

NDMC Areas |

Delhi Cantonment Board Areas |

|

Male |

1 percent |

1 percent |

1 percent |

|

Female |

1 percent |

1 percent |

1 percent |

|

Joint Ownership |

1 percent |

1 percent |

1 percent |

Avail Tax benefit on Stamp Duty (Policy Matters S01E74)

Also Read: Best Areas for expats to live in Delhi

How to Calculate Stamp Duty in Delhi?

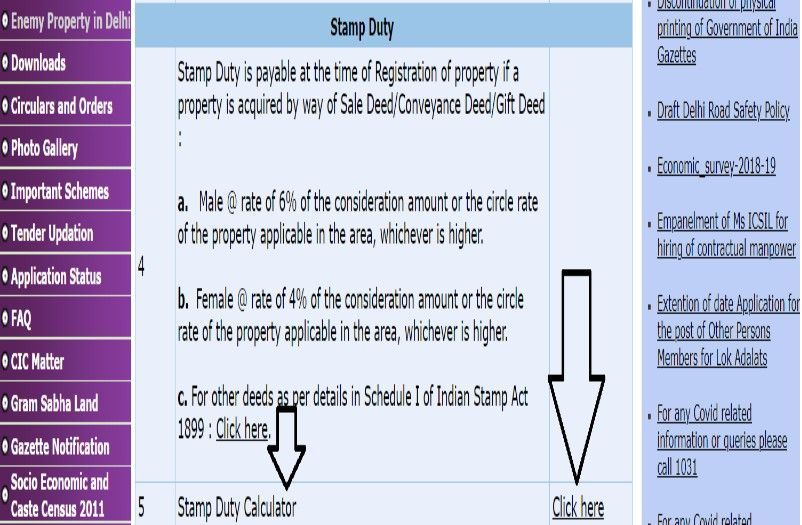

The Revenue and stamps department of Delhi has provided an excellent facility to calculate stamp duty online. To calculate the stamp duty online in Delhi, follow the below-mentioned steps.

Step 1: Log in to the website of the Revenue and stamps department of Delhi, i.e. revenue.delhi.gov.in.

Step 2: Under the E-registrar tab, click on the “Important Information regarding Registration of Property”.

Step 3: Now, under the stamp duty section, click on the Stamp Duty Calculator.

On the website of revenue.delhi.gov.in you can calculate stamp duty in Delhi

On the website of revenue.delhi.gov.in you can calculate stamp duty in Delhi

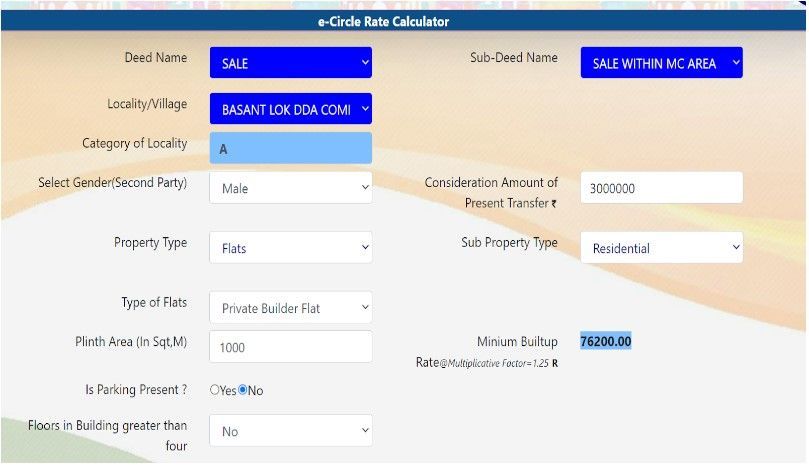

Step 4: The system will be redirected to https://eval.delhigovt.nic.in/

Step 5: Here, choose the details such as Sub-registrar, Deed name, Locality and subdued name.

On the DORIS website you can calculate the circle rate of Delhi

On the DORIS website you can calculate the circle rate of Delhi

Step 6: Once you select the following details from the drop-down list, click on the submit button.

Step 7: As soon as you click on the submit button, the system will be redirected to the following screen.

To get the circle rate of your property you need to fill in the above details on the DORIS website.

To get the circle rate of your property you need to fill in the above details on the DORIS website.

Step 8: Here, you will have to fill in the following details.

Step 9: Once all the details are filled, the stamp duty rates will be visible on the screen.

View calculation of Stamp Duty in Delhi

View calculation of Stamp Duty in Delhi

The details will include stamp duty, registration charges and final stamp duty, among others.

How to Pay Stamp Duty and Registration Charges in Delhi Online

Once you have calculated the stamp duty and registration charges, you have the facility to pay it online. Here is a step-by-step method to pay stamp duty in Delhi online.

Step 1: To pay the stamp duty in Delhi online, log in to the official website of Stock Holding Corporation Ltd, i.e. https://www.shcilestamp.com/

Step 2: Under the state’s list, select the NCT of Delhi option.

Step 3: Proceed for online payment of the stamp duty. The payment can be made via UPI/NEFT/IMPS/Debit Card/Credit Card etc.

The website of the stock holding corporation also displays the list of Sub-registrars and their office addresses. The website also displays the list of documents that are to be registered compulsorily. The list of optionally registrable documents is also displayed alongside.

To access the list of authorized stamps collection centres, click Here

List of Documents for Stamp Duty Payment in Delhi

-

All original records are accompanied by a single collection of copies.

-

Address the buyer’s, seller’s, and witnesses’ evidence.

-

On two copies of the papers, two passport-sized portraits of the buyers and sellers.

-

E-Stamp paper with the right stamp duty amount.

-

E-Registration fee receipt, along with an undertaking or affidavit.

-

Copy of PAN card or Form 60 that has been self-attested.

-

In the case of a plot or property, a no-objection certificate (NOC) is required.

-

Sale Deed

-

Proof of the buyer, seller, and witness identities.

Also Read: National Generic Document Registration System

Points to Consider before Paying Stamp Duty in Delhi

-

The stamp duty and registration charges are considered an integral part of the property registration process, and the fee must be deposited compulsorily.

-

The state government has kept the stamp duty rates a bit lower for women applicants. This was done to promote women’s property ownership.

-

Although the stamp duty and registration charges are a one-time fee, the failure to pay the stamp duty might lead to a heavy penalty from the state exchequer.

-

It must be highlighted that the stamp duty and registration charges are exempted under section 80 C of the Income Tax Act, but this limit is capped at Rs 1.5 lakh per annum.

Comments